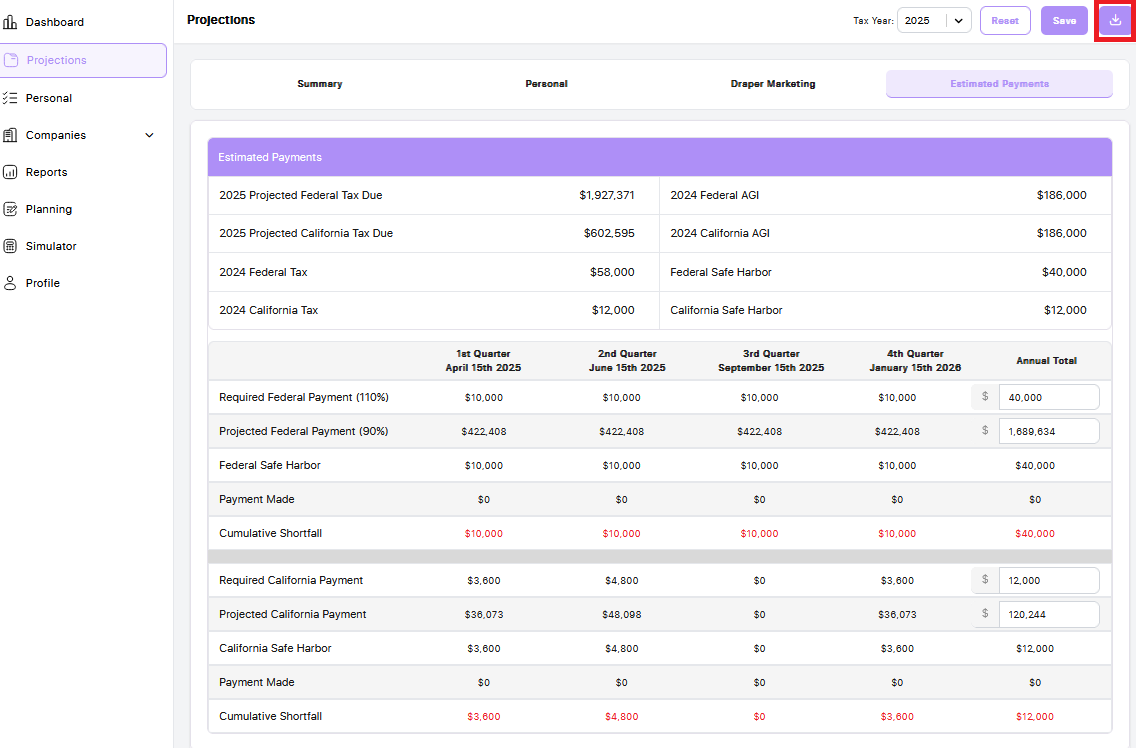

To view estimated payments for your client based on their projection data, go to the Projections tab in the left-hand navigation, then click on the Estimated Payments tab.

Here, you'll see a detailed breakdown including:

-

Projected Tax Due (Federal and State)

-

Required Estimated Payments

-

Safe Harbor Amounts

-

Payments Made

-

Cumulative Shortfall

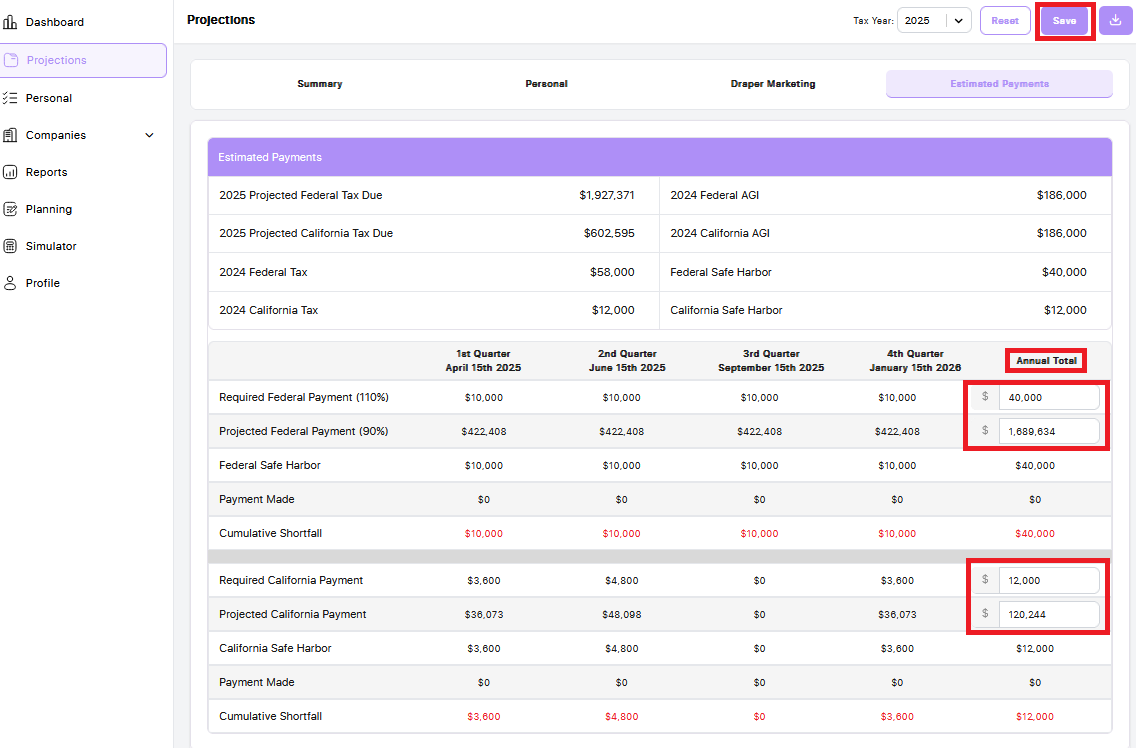

You can edit the annual total for the following payment types:

-

Required Federal Payment (110%)

-

Projected Federal Payment (90%)

-

Required State Payment

-

Projected State Payment

To adjust a total:

-

Click into the total amount you'd like to change.

-

Enter the new annual total.

-

Click Save.

Once saved, the system will automatically distribute the new annual amount evenly across all four quarters.

To generate a PDF version of the Estimated Payments screen:

-

Click the Download button located at the top right of the page.

-

A PDF version of the report will be generated.

-

Save or share the PDF with your client as needed.

This PDF includes a clean summary of quarterly payments and is ideal for sharing with clients to guide their payment scheduling.