From the Personal tab in the client portal, you can enter all of your client’s personal details for their projection. It's recommended to have a copy of the client’s Form 1040 on hand and to proceed tab by tab—starting with Demographics and ending with State Inputs—saving your progress as you go by clicking the purple Save button.

Use the toggle in the upper right-hand corner to select the year for which you’d like to view or edit projection details. If needed, the Reset button will clear all entered data in the selected tab.

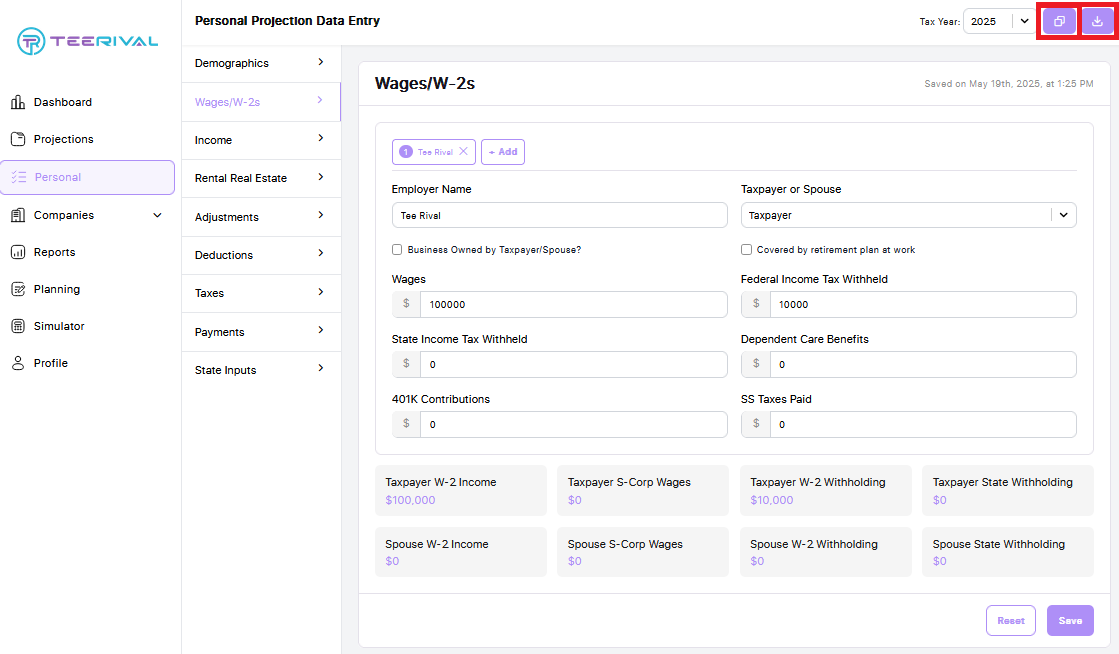

The purple buttons highlighted below allow you to either copy personal data from a prior year or download an Excel worksheet containing the projection details.

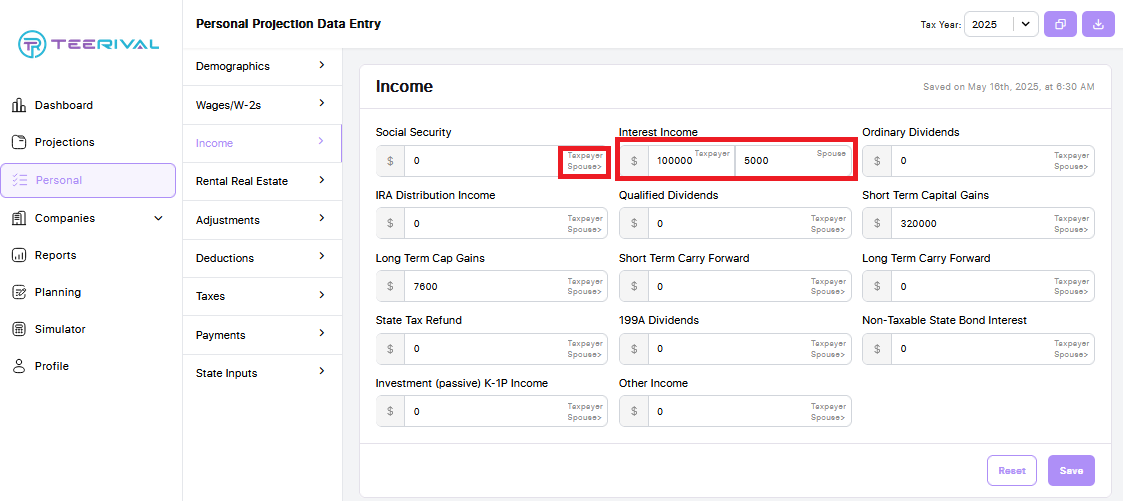

The various tabs in the personal projection data entry section allow you to specify whether the data should be attributed to the Taxpayer/Business Owner or their Spouse.

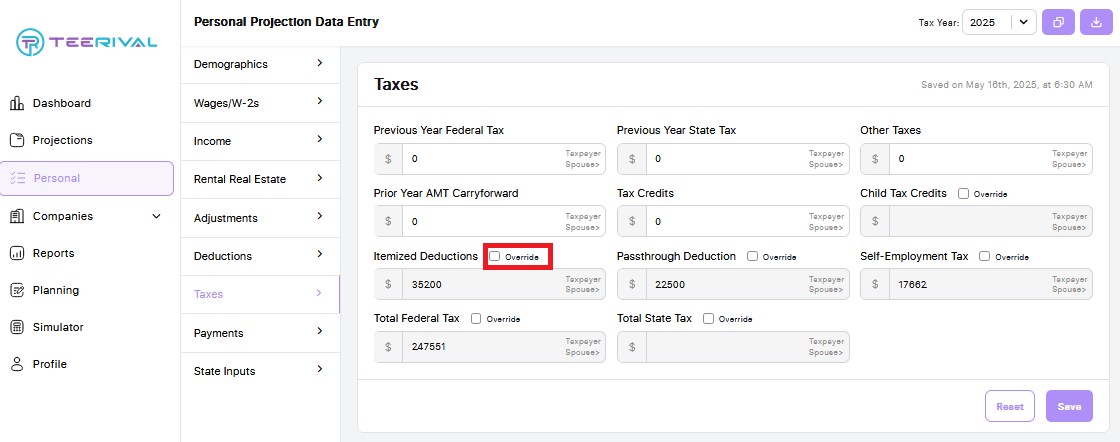

You also have the ability to override certain calculations from the Taxes tab within the personal data entry section. To do this, simply check the Override box and enter the desired amount.