If you have rental real estate losses and earn more than $75,000 ($150,000 for joint returns) in other income (like W-2 or investments), you typically can't deduct those losses. However, if you're considered a Real Estate Professional, you can deduct real estate losses against other income.

What is a Real Estate Professional?

To qualify as a Real Estate Professional, you must meet two criteria:

-

More than 50% of your work must be in real estate activities.

-

You must spend at least 750 hours per year in real estate activities in which you materially participate.

Why It Matters

If you qualify as a Real Estate Professional, you can deduct rental real estate losses against other income, regardless of your income level. This can result in significant tax savings.

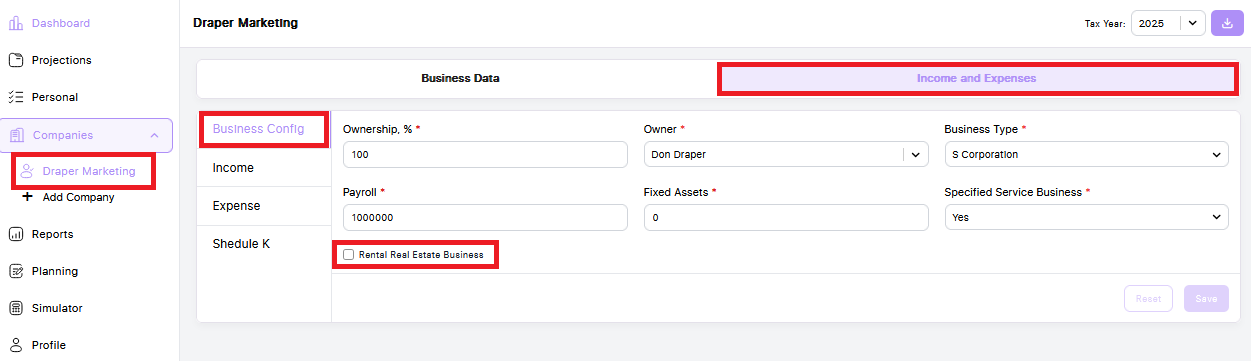

You can designate a company as a Rental Real Estate Business in the client portal.

-

Go to the Companies tab in the left-hand navigation and select the desired company.

-

Click on the Income and Expenses tab at the top.

-

In the Business Configuration section, check the box for Rental Real Estate Business.

-

Be sure to click Save after selecting the option.